Direct investing

Trade from a universe of 15,000+ tickers across US, UK, Swiss, and Hong Kong markets - China markets

EXCHANGES AVAILABLE

Trade global instruments

UCITS

Tax-efficient ETFs (UCITS) that offer the same access to US and global indices without being subject to US estate taxes of up to 40%

Learn more

Global Stocks

Access Nestlé, HSBC, Roche, and more - directly on Swiss, UK, and Hong Kong exchanges, in their home currencies

ADRs

American Depositary Receipts (ADRs) let you invest in foreign companies incorporates and listed outside the US—while trading in US dollars on American exchanges

Learn moreUS Stocks

Direct access to individual US stocks and companies listed on major US exchanges like NYSE and NASDAQ

Learn more

Commodities

Gain exposure to precious metals and commodities while hedging against rupee depreciation

Bonds

Access bonds with strong credit ratings, including AAA-rated U.S. Treasuries

Advanced order types

Market orders

Trade instantly at any price available in the market. Ideal for entering a position quickly

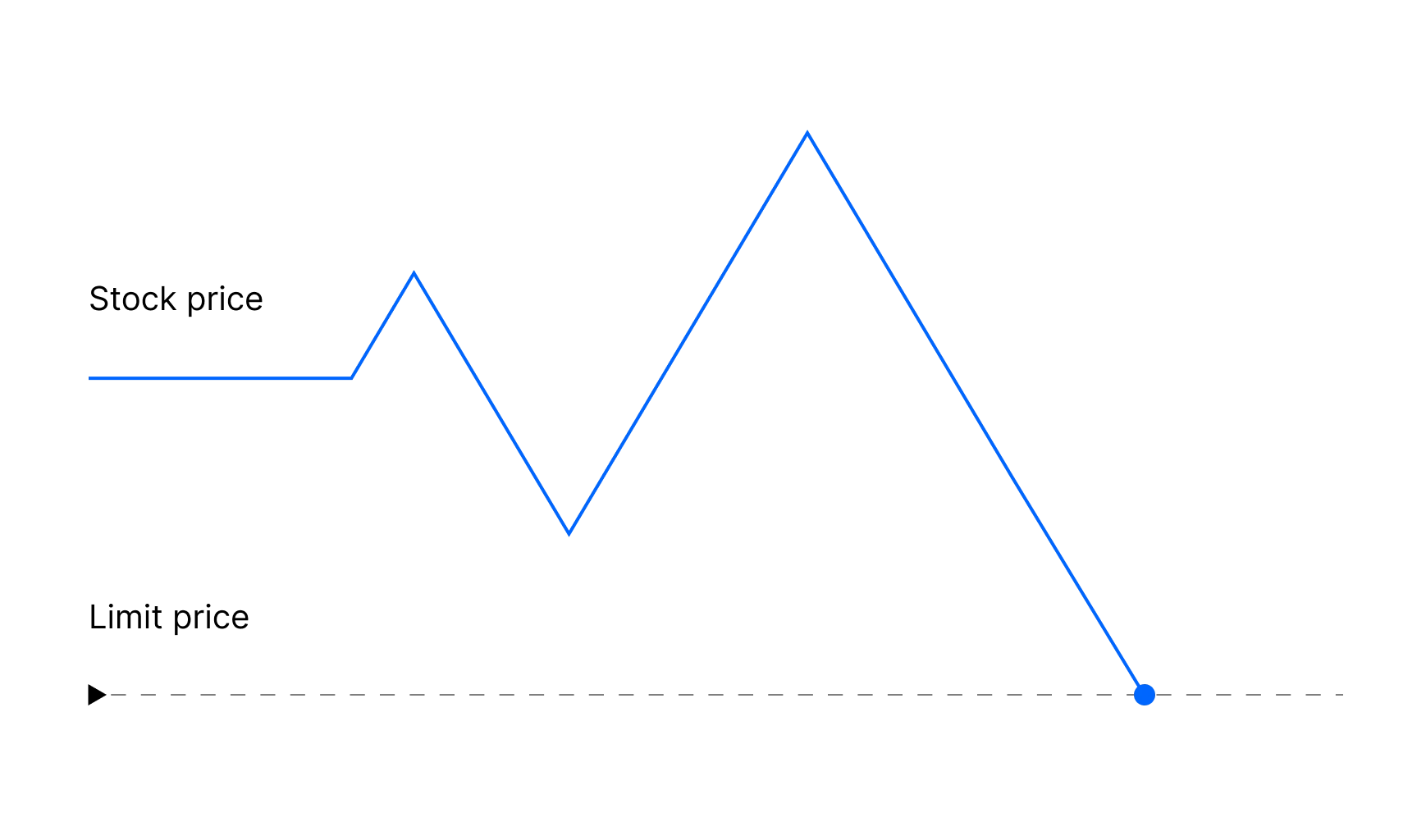

Limit orders

Buy at a maximum price or lower. Ideal for controlling entry cost and avoiding overpaying.

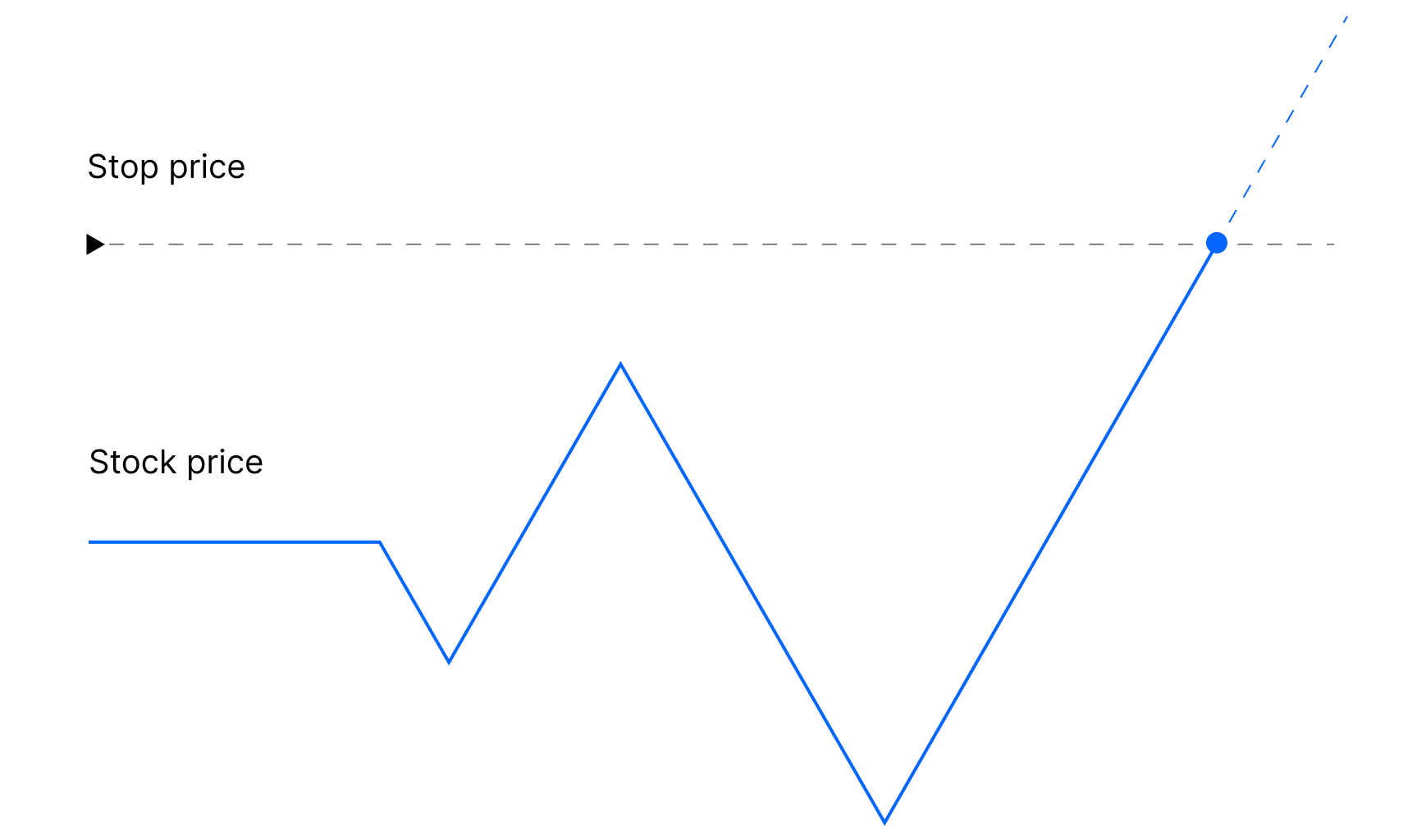

Stop orders

Automatically trigger a market order when the price reaches your set level. Ideal for entering at a breakout point.

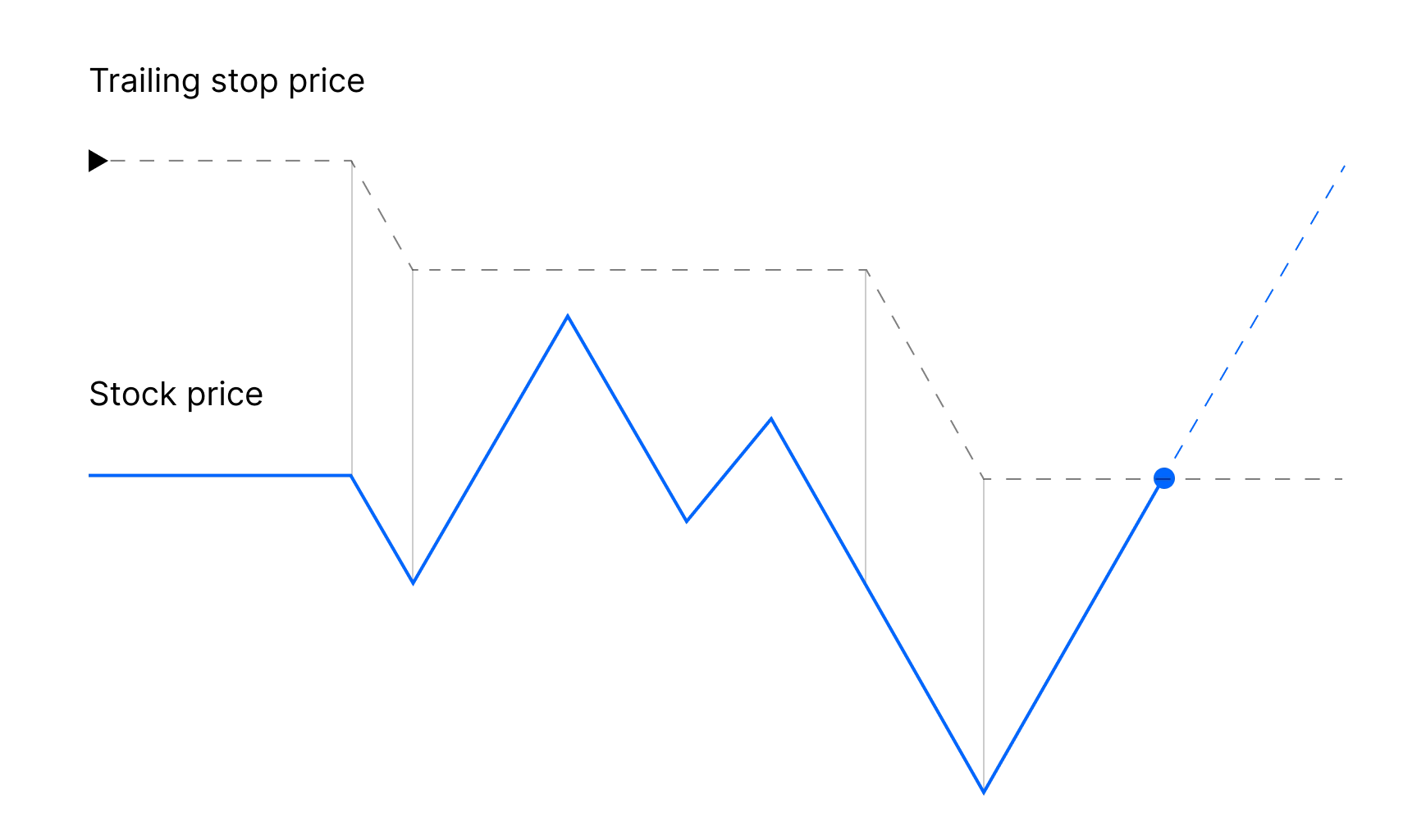

Trailing stop orders

Automatically trigger a market order when the price rises by a set amount from its lowest point. Avoid entering too early while still capturing upward momentum.

Global search

Single view to explore, identify, and compare opportunities across markets

Set recurring investments

Set, forget, and build wealth with discipline

Create watchlists

Create personalized watchlists to track the stocks, ETFs, and markets you care about

Direct market access

Your trades are routed directly to the markets realtime. No market makers or delays involved.

You own your assets

Held with our custodian Interactive Brokers under your name. Assets are SIPC Insured upto $500,000.

Enterprise-grade security, certified for sensitive and regulated data

India's lowest commissions for

global markets

Onboarding

Get started in 3 simple steps

Transfer funds in and out worldwide, as long as the bank account is in your name

White glove onboarding available

White glove onboarding availableLearn

Resources

How to Invest in China Stocks from India

Compare ADRs, ETFs, Hong Kong shares, mutual funds and tax implications.

Read →

Invest in Swiss Stock Market from India

Direct shares, UCITS ETFs, US ETFs, ADRs - explore tax, LRS rules, and platform options

Read →

How to Invest in Irish Stocks and UCITS ETFs from India

UCITS ETFs, ADRs, and LSE stocks explained with tax efficiency in mind

Read →