Make your child's dream of studying abroad a reality

Make your child's dream of studying abroad a reality

Make your child's dream of studying abroad a reality

Safeguard your child's foreign education fund from local currency fluctuations by investing in stable dollar-denominated accounts.

Safeguard your child's foreign education fund from local currency fluctuations by investing in stable dollar-denominated accounts.

Safeguard your child's foreign education fund from local currency fluctuations by investing in stable dollar-denominated accounts.

How it works

How it works

How it works

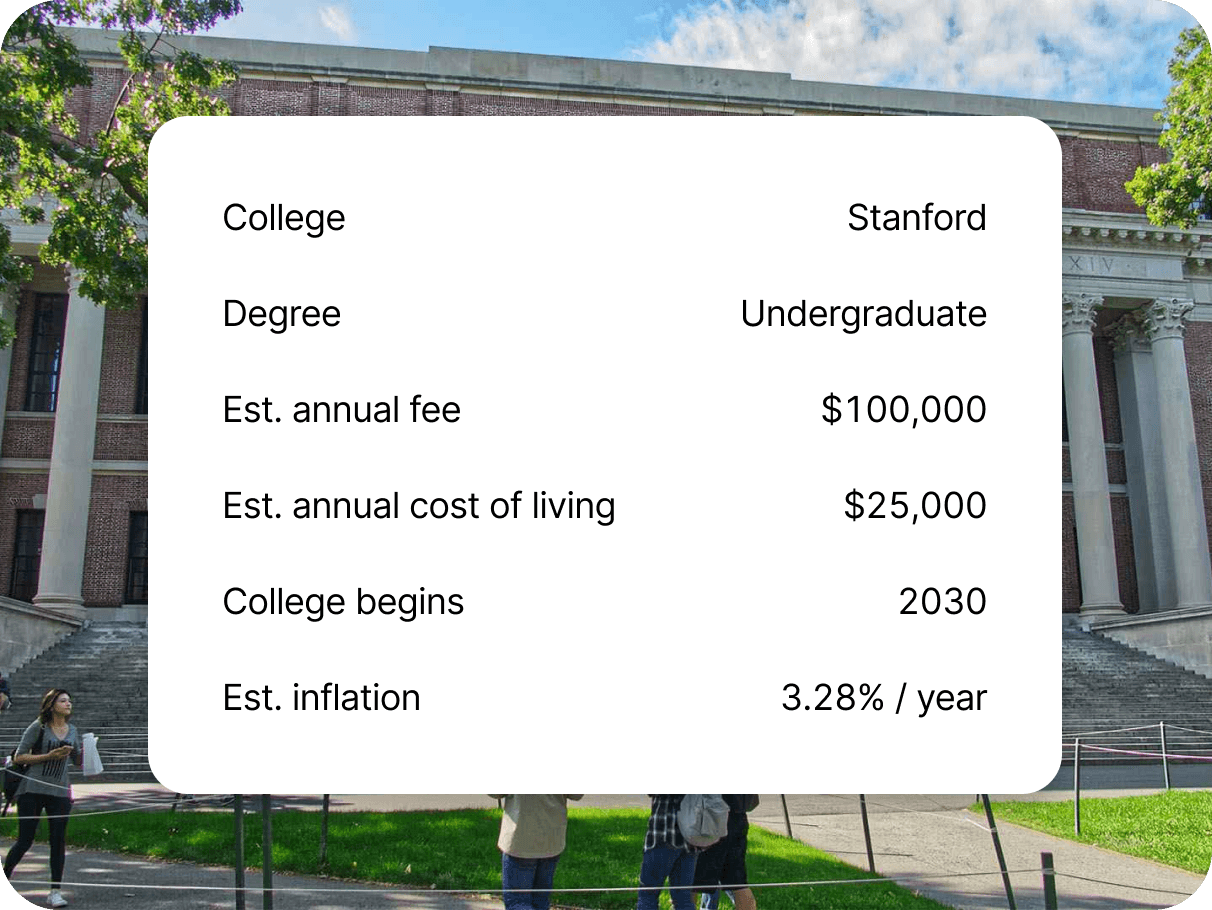

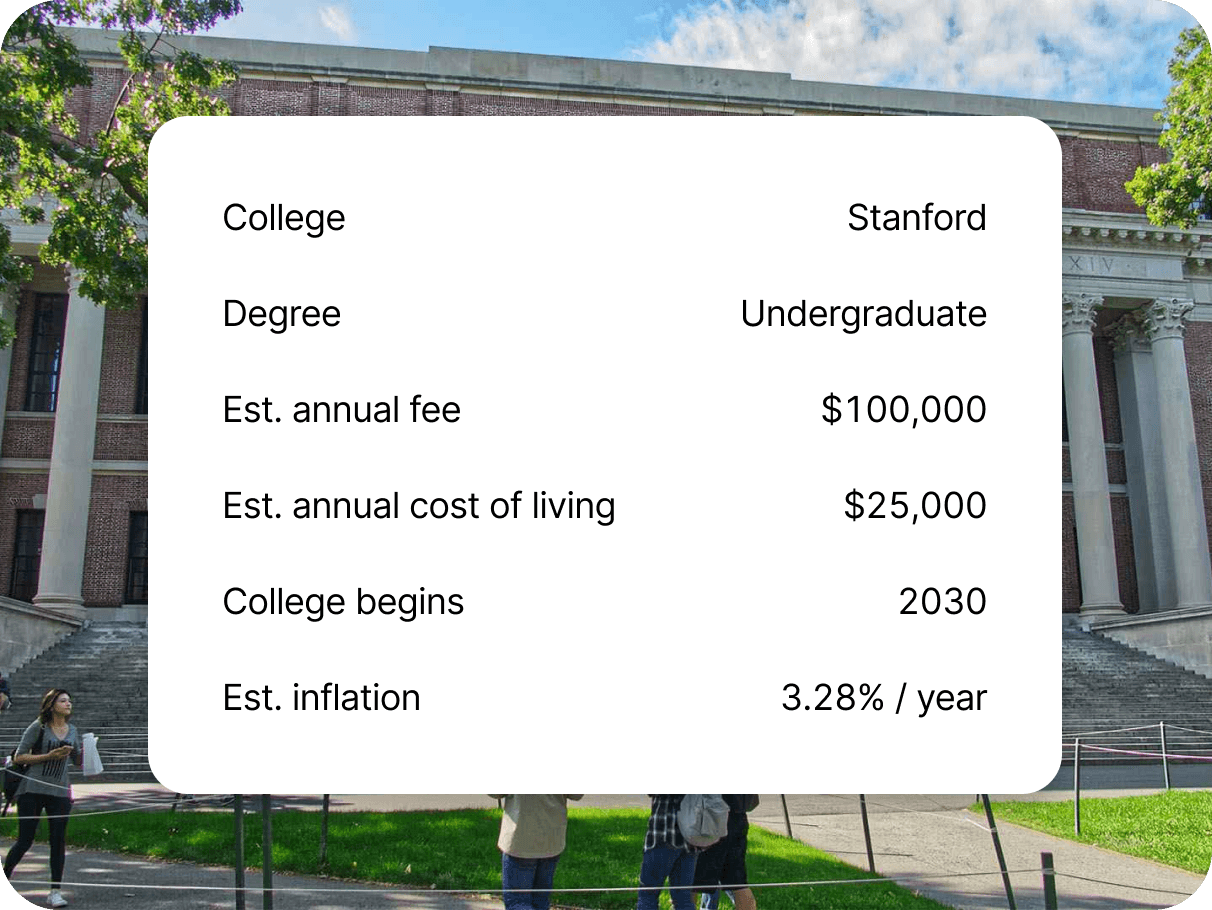

1. We calculate costs

1. We calculate costs

1. We calculate costs

We’ll help you estimate the future cost of college, accounting for inflation and rising expenses, and determine how much you need to save each year to achieve your goal.

2. View your plan

2. View your plan

2. View your plan

We’ll review your savings plan in detail during a personalized call. Our experts can also address any tax or cross-border investment questions you may have.

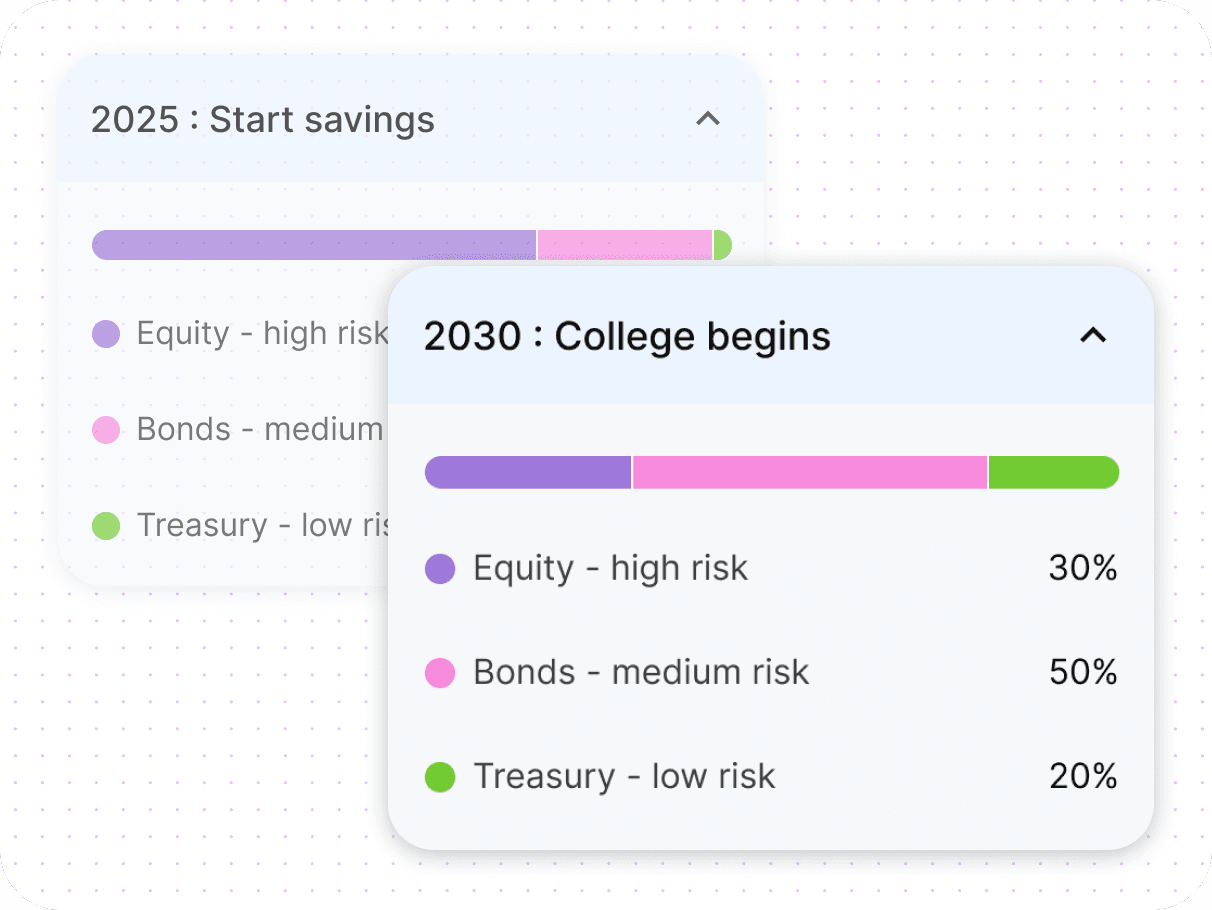

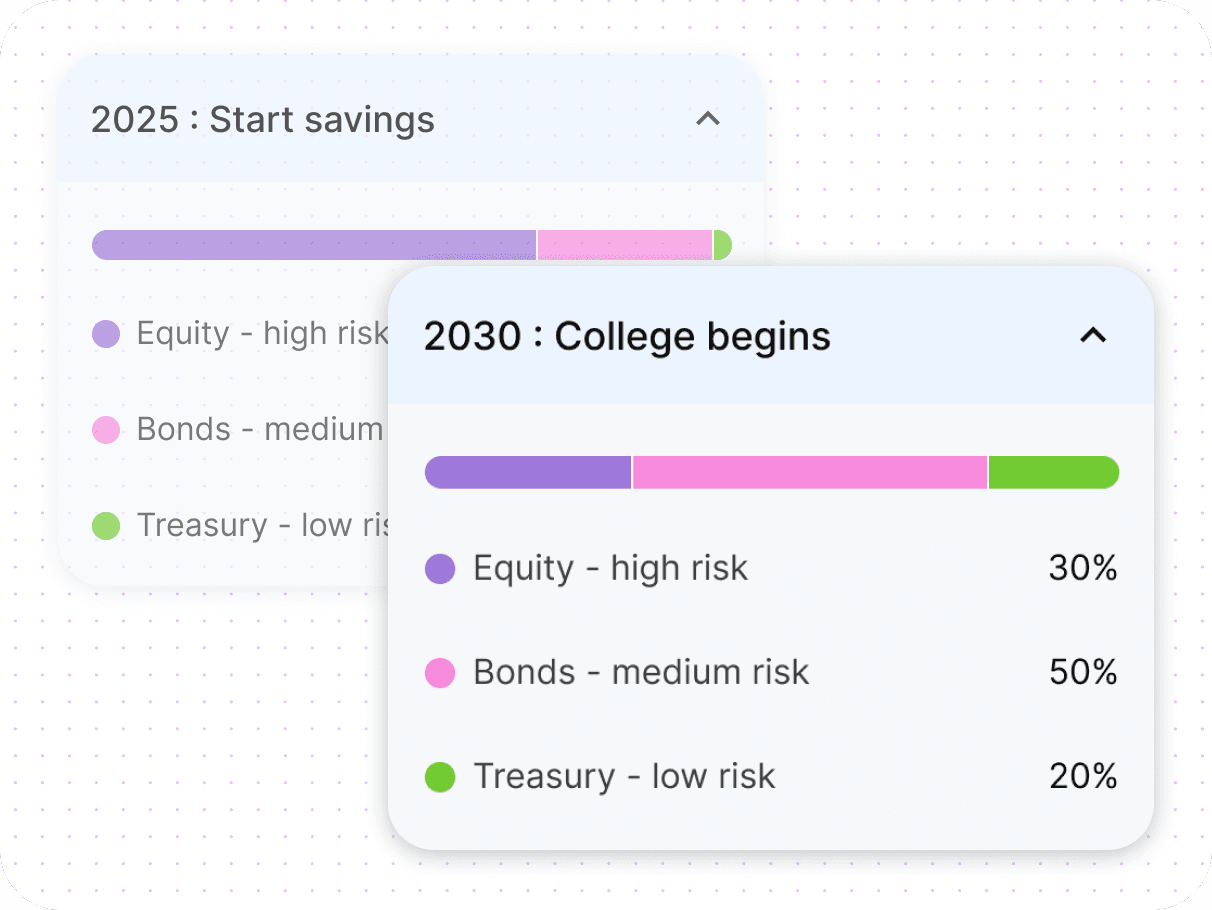

3. We manage your risk

3. We manage your risk

3. We manage your risk

As college gets closer, our software will automatically adjust your allocations to align with your plan, reducing risk and ensuring you're well-positioned to achieve your savings goals.

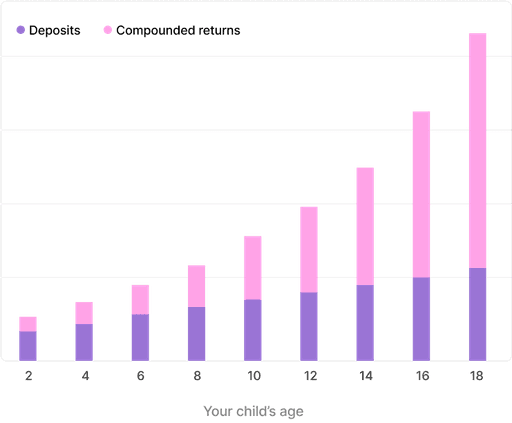

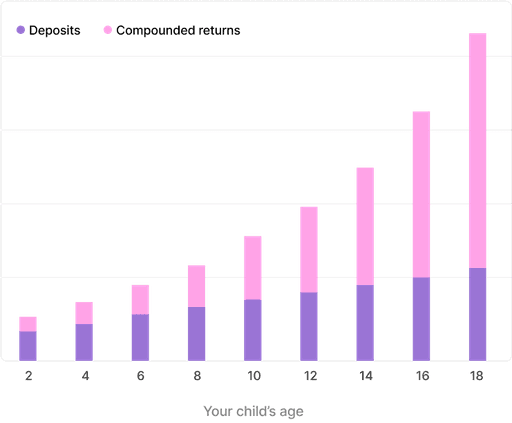

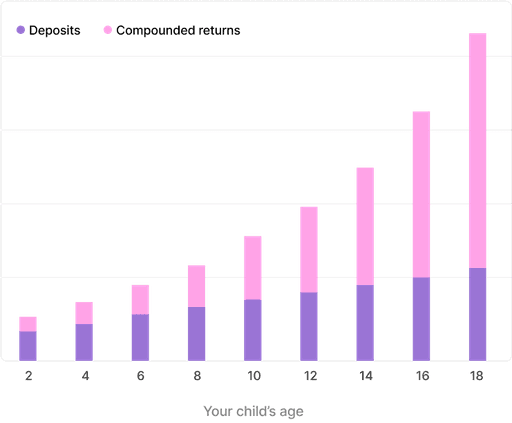

Saving early in dollars will help you (and your kids) pay a lot less later

Saving early in dollars will help you (and your kids) pay a lot less later

Saving early in dollars will help you (and your kids) pay a lot less later

Saving early gives your money more time to grow, thanks to the power of compounding. It also allows you to benefit from long-term capital gains, which are taxed at lower rates.

Saving early gives your money more time to grow, thanks to the power of compounding. It also allows you to benefit from long-term capital gains, which are taxed at lower rates.

Pricing

Pricing

Pricing

We charge based on Assets Under Management (AUM), with a tiered structure that lowers rates as your assets grow. We do not charge any additional fees including transaction fees.

We charge based on Assets Under Management (AUM), with a tiered structure that lowers rates as your assets grow. We do not charge any additional fees including transaction fees.

AUM $1,200 - $10,000

AUM $1,200 - $10,000

AUM $1,200 - $10,000

1.00%

1.00%

1.00%

/year

/year

/year

Personalized portfolio

Personalized portfolio

Personalized portfolio

No transaction fees

No transaction fees

No transaction fees

Dedicated financial advisor

Dedicated financial advisor

Dedicated financial advisor

Weekly market updates

Weekly market updates

Weekly market updates

AUM $10,001 - $100,000

AUM $10,001 - $100,000

AUM $10,001 - $100,000

0.80%

0.80%

0.80%

/year

/year

/year

Personalized portfolio

Personalized portfolio

Personalized portfolio

No transaction fees

No transaction fees

No transaction fees

Dedicated financial advisor

Dedicated financial advisor

Dedicated financial advisor

Weekly market updates

Weekly market updates

Weekly market updates

AUM $100,001 and above

AUM $100,001 and above

AUM $100,001 and above

0.60%

0.60%

0.60%

/year

/year

/year

Personalized portfolio

Personalized portfolio

Personalized portfolio

No transaction fees

No transaction fees

No transaction fees

Dedicated financial advisor

Dedicated financial advisor

Dedicated financial advisor

Weekly market updates

Weekly market updates

Weekly market updates